One of the final steps the IRS will sometimes take to collect back taxes that remain unresolved, is to send a revenue officer. An IRS revenue officer is someone who is tasked specifically to show up at your house or to call you on the phone and demand payment of your past-due balance. These revenue officers may come off as compassionate, but be assured they have only one goal, and that is to get their money. They are not out to help you, and they are not as flexible as they might seem.

In fact, the offer they make you may well be designed to get you to pay a good deal more than you should actually owe. They have neither the time nor the desire to look through your tax records to double-check the agency’s assessment. They are, generally, there to protect their own interests, not yours.

If you are facing a tax revenue officer from the IRS, you want someone in your corner who knows how to fight back. That’s Instant Tax Solutions. We can help you to prepare for the visit or phone call, and we can help to represent your interests when the time comes for negotiations.

You don’t have to bear the heavy burden of back taxes alone. Let us help you with mailings and phone calls from the IRS, and let us protect your legal rights and interests. Get in touch today at (888) 921-3781 or reach out online to schedule a free consultation with our experienced Houston tax relief lawyers.

Facing Houston IRS Tax Revenue Officer Negotiations

Dealing with a Houston IRS tax revenue officer can be intimidating, and that is by design. You may be scared and have no idea what to do or what to say. Even the IRS website is misleading regarding what these agents do. It claims that revenue officers are there to “educate” you on your obligations and to provide “guidance and service” on your financial issues. It also claims they are there to make you aware of your rights.

What the agency does not say is that it is possible to negotiate with a revenue officer, but you may need expert help to do so. When you have a scheduled appointment with an IRS tax revenue officer, the first thing you should do is contact Instant Tax Solutions for help. We will go over your finances with you in detail to see where you stand, and we will help you to negotiate a reasonable settlement with the agency, which can often be lower — sometimes significantly so — than the revenue officer will claim.

What Is a Revenue Officer?

A tax revenue officer from the IRS is, quite simply, a debt collector. They are there to tell you what you owe and get you to pay it. These agents are also those who collect additional information needed to process your taxes or begin audits, so if you get a notice that your taxes are being audited, a revenue officer may show up to help the agency get all the information it needs. They are unarmed civil servants who conduct scheduled visits. They may often seem compassionate and intimidating at the same time.

In the end, however kind they may seem, it is important to remember that they are not your ally. Your expert tax relief professionals at Instant Tax Solutions will fulfill that role and protect your rights.

Will an IRS Revenue Officer Show Up Unannounced?

This is a complex question. Once upon a time, the IRS routinely showed up out of the blue to surprise delinquent and unresponsive taxpayers who owed back taxes. This practice largely ended with the passing of the 2023 Inflation Reduction Act. That said, the IRS does still maintain the right to make such visits, so they can simply show up if they choose. They claim, however, that unannounced visits will only occur in very unique situations.

This new policy is good for you. It means that you get a say in the means and timeframe of your negotiations with the IRS. That allows you to prepare for what will happen, to go over your finances, and to address your tax obligations before the meeting occurs.

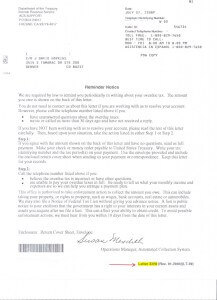

Usually, you will receive several notices and letters from the IRS before a field visit happens, including past-due notices and warnings about the consequences of failure to pay. Remember that their goal is to pressure you toward paying the amount due. It is always in your best interests to have someone in your corner who can balance the negotiations — a tax expert from Instant Tax Solutions.

Did You Receive a Houston IRS Revenue Home Visit?

An IRS revenue home visit will occur wherever your primary tax records are kept. If the issue is with personal income taxes, the visit will likely be to your home. If the issue is with your business, they will likely request a meeting at your business location (which may also be your home, in some cases). The goal is to have easy access to your financials so you can look through them and provide them with any missing information they seek, as needed.

These officers may demand you produce these records, particularly in the case of records that have been requested several times prior. They may also seek records to examine if you claim a hardship or you are attempting to claim a debt that is currently not collectible.

Whatever the reason for their visit, dealing with an IRS revenue officer is usually not good news for the taxpayer. That’s why it is important to have experienced help from a qualified tax relief professional. We can help you determine how to prepare, and any potential offer you could make to avoid collection actions that would adversely affect your finances.

How to Deal with a Houston IRS Revenue Officer Visit

The moment you receive a notice that the IRS wants to meet with you, the first thing you should do is seek professional tax relief help. We can go through your finances in detail, explore your options to negotiate a settlement, and sometimes even reduce your tax burden. We can help you gather evidence to support your cause and even represent your interests to the IRS.

Above all, when you receive a request for an appointment with a revenue officer, be prompt. Avoiding them or trying to delay can be extremely costly. It can lead to deeper audits of your finances, levies against your bank accounts or property seizure, wage garnishment, or even the agent showing up unannounced as a last resort. Addressing the situation quickly looks better for you and can lead to a better outcome. Preparing for an IRS revenue officer visit is a step-by-step process, and we can help you get through.

Preparing for an IRS Revenue Officer Visit

The first thing to do when preparing for a Houston IRS revenue officer visit is to keep the right mindset. It can be easy to panic, but keeping calm and making a plan will allow you to have a much better chance of coming out ahead of the game.

First, go over your financials and past tax records for the past three to five years in detail. Make sure that everything you reported is accurate and that you did not miss any credits or deductions you could have taken. As you go through the information, organize it and be prepared to present it in a clear fashion, particularly if you intend on negotiating relief of some fashion. The officer does not have the time or patience to organize your records for you.

Next, review the options available to you for resolving the situation. Are you going to claim the debt is not collectible for hardship? Request an offer in compromise? Work out a payment plan? Whatever your goal is, know the options in detail and be prepared to present your negotiation. Prepare a detailed proposal, which should include all the information needed, from the relief you seek to any penalty abatements included and beyond.

Understand that the officer is likely to counter your offer with one of their own, and their goal is to get you to pay more. Be clear and stand firm, backing up your claim with detailed documentation.

On the day of the visit, be prompt, well groomed, and have all of your documents on hand and organized. Keep a calm and determined mindset and be patient, but again, resolute in your position. The officer is not concerned with your ability to reduce the amount you owe, nor your ability to comfortably pay. You must protect yourself. That said, be ready to compromise if needed. This is a negotiation, not a demand session.

Try to work with the officer instead of setting an adversarial tone right out of the gate. Things may go much smoother if you do. The IRS sends a revenue officer when they want things resolved. This means that even if you appeal the decision, you may have to face them again.

Think of this process as one of collaboration. You and the IRS revenue officer are out for a common goal: to resolve your back tax issues as quickly and resolutely as possible. Your job is to do that without paying more than you should or than you realistically can afford to pay.

Get Help Dealing with Houston IRS Revenue Officers Today

At Instant Tax Solutions, we are here to offer experience and expertise with reducing your back tax burden. Over the years, we have helped thousands of people like you with releasing levies, reducing tax debt, negotiating settlements, and helping with IRS revenue officer interviews. Don’t go it alone. Let us help.

We can go over your finances and provide all the options available for tax relief, then help you come up with a reasonable plan to implement the strategy. We are ready to be a dedicated partner on your road to financial solvency and peace of mind. Just call (888) 921-3781 or use our online form for a free consultation today.

Revenue Officers are adept at developing creative tax collection practices and are trained to pursue any avenue necessary to force payment in full. The game plan varies often depending on the latest law changes.

Revenue Officers are adept at developing creative tax collection practices and are trained to pursue any avenue necessary to force payment in full. The game plan varies often depending on the latest law changes. Taxpayers who owe back taxes will eventually receive notices from the IRS Collections office. These notices mean the beginning of a series of high-powered collection action backed by the government. There is a current movement within the unit to escalate the recovery of back taxes.

Taxpayers who owe back taxes will eventually receive notices from the IRS Collections office. These notices mean the beginning of a series of high-powered collection action backed by the government. There is a current movement within the unit to escalate the recovery of back taxes.